April Newsletter 2025

Macro Overview

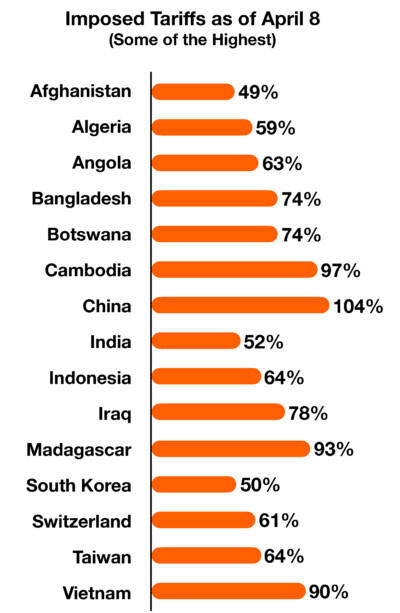

Turmoil sweep throughout the global markets as the tariff announcements were broader and more significant than expected. Economic contraction worries have surpassed inflation fears as the toll of tariffs on global trade casts doubt on the rate of continued expansion.Major equity indices globally shed trillions in valuations as the fear of disruption in global trade led to uncertainty and retaliation among international trading partners. Commodity prices as well as cryptocurrency values tumbled as uncertainty pummeled through the domestic and international financial markets. Cryptocurrencies plunged worldwide as bonds and cash became safe havens amid spontaneous selling pressures and uncertainty roiled global markets.Consumers rushed to stores and auto lots nationwide in anticipation of increasing prices for imported products. A consumer-led contraction in economic expansion is expected to follow higher prices driven by the newly imposed tariffs. Economists and analysts believe that the wealth effect will start to influence consumers as the dramatic pullback in equity markets devalues stock portfolios for millions of Americans.What was not expected was the inclusion of numerous smaller exporting countries which will also be imposed a minimum 10% tariff on all goods exported to the U.S. Most businesses end up passing on much of the cost through higher prices to suppliers and consumers. This is why tariffs are often described as “taxes on consumers.” The tariffs will have a broader impact on consumers, who will likely bear the cost of the tariffs, leading to higher prices and a potential economic slowdown.The White House communicated that the tariffs that became effective on April 5 & 9th will remain in effect until such a time that the President determines that the threat posed by the trade deficit and underlying nonreciprocal treatment is satisfied, resolved, or mitigated. Treasury Secretary Scott Bessent said on Sunday April 6th that more than 50 countries had called the administration seeking negotiations on tariffs.Sources: Treasury Dept., WhiteHouse.gov., Federal Reserve

Volatility Soars As Tariffs Are Announced – Global Equity Overview

The announcement of the tariffs along with growing concerns of weakening consumer demand led equity indices lower in early April. Souring consumer sentiment in March and stubborn inflation worries were already pressing before the tariff turmoil, which only added to the turbulence.Global equity indices shed gains that had accumulated earlier in the quarter. Broad pullbacks across Europe and Asia led global markets lower as the fear that tariffs would disrupt sensitive supply chains and curtail trade. The S&P 500 Index revealed that the energy sector and utilities saw the most stability of all sectors in the first quarter.The Volatility Index, also known as the VIX, rose significantly as the tariff announcements were made. Extreme volatility and large volume trading sent equity indices broadly lower, affecting nearly every publicly traded company on the exchanges. Such volatility is perceived by traders and some investors as an opportunity to buy quality companies at discounted valuations. (Sources: S&P, Dow Jones, Bloomberg)

Bond Yields Fall With Rush To Bonds – Fixed Income Overview

It was the first time since the onset of the pandemic in March 2020 that bonds rose and stocks fell in a three-month period. Investors tend to buy bonds when they believe growth is going to slow and eventually force the Federal Reserve to ease monetary policyThe growing fear of a looming recession is pushing yields lower as bond prices edge higher. Inflation has now become much less of a worry.The 2-year Treasury bond yield reached its lowest level since 2022, as government and corporate bonds were sought after as safe havens as turmoil affected markets. The yield on the 10-year Treasury bond ended the 1st quarter at 4.23%, down from 4.79% in January. (Sources: Treasury Dept, Federal Reserve)

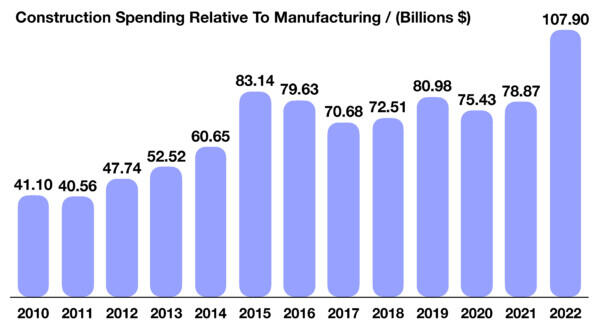

Infrastructure Build Out & Manufacturing Remain Intact – Domestic Economic Expansion

The most recent data released by the U.S. Department of Commerce revealed that construction spending, like most of the incoming data of late, is slowing. Areas of weakness included multi-family, home improvement, manufacturing, and commercial real estate. There were some encouraging signs of strength across sectors geared towards infrastructure improvements. Aging U.S. highways and an antiquated electrical grid, have prompted billions of dollars to be allocated for improvement and modernization.The increasing demand for electricity brought about by the rapidly expanding A.I. industry, has revitalized the need for utility companies to expand and build new facilities nationwide. Deregulation in the energy and utility sectors is expected to expedite the improvement and building process substantially. In 2020, Covid upended global supply chains and increased costs for manufacturers in the U.S. and abroad. Many of the derailed supply chains have still not been completely resolved. (Sources: U.S. Department of Commerce)

Change in Consumer Sentiment & Behavioral Spending Patterns Is Inevitable

Since consumer expenditures represent nearly 70% of Gross Domestic Product (GDP), any behavioral change in consumer expenditures may result in a retraction of economic growth. For decades, the valuations of stock and home prices have directly affected how freely consumers spend. Historically, as stock and home values have risen, so has consumer sentiment and the propensity to spend. Since higher income consumers hold more stocks and have larger home valuations than lower income consumers, any changes in stock or home values determines changes in spending behaviors.Analysts, economists and the Federal Reserve are closely following retail sales and spending patterns of the top 10% earners of consumers, which represent roughly 50% of all consumer expenditures. Historically, any sudden increase or decrease in stock valuations can alter the spending behavior of wealthy consumers. Data from prior market swings has shown that a 10% rise in stock prices equates to a 1% rise in consumer expenditures by the wealthy, while a drop in stock valuations poses the same dynamic but with a contraction in expenditures.Sources: Federal Reserve, Bureau of Labor Statistics

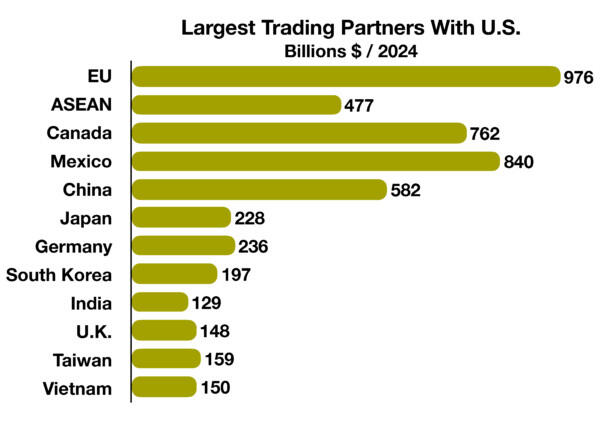

Largest Trading Partners With U.S. – Global Trade Overview

The onslaught of tariffs has been widespread, affecting products from nearly every trading partner of the U.S. According to UN Trade & Development data, global trade hit a record high of nearly $33 trillion in 2024, up $1 trillion from 2023. In 2023, the United States’ top trade partners, based on combined import and export values, were Mexico, Canada, and China, with nearly $798 billion, $773 billion, and $575 billion in goods and services, respectively.The single largest trading partner with the U.S. is ASEAN, the aggregation of South Asian Nations including Brunei Darussalam, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand and Vietnam. Other major trading partners also saw tremendous trading activity in 2024, including Japan, Germany and South Korea.Source: UN Trade & Development

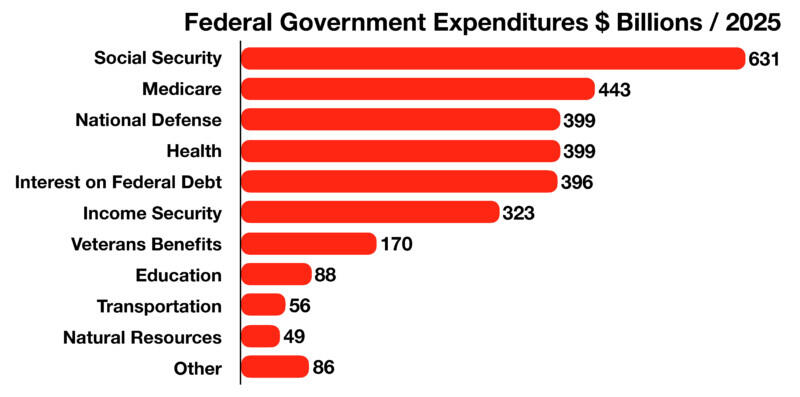

The Financial State of Medicare – Healthcare in Retirement

Social Security and Medicare account for nearly 40% of all federal spending excluding interest on the national debt, and within a decade the Congressional Budget Office predicts that will rise to roughly half. Both programs face financial difficulty going forward, even with additional taxes, lower expenditures, or benefit cuts.The Medicare Part A Trust Fund is expected to be depleted by 2031, according to the 2023 Medicare Boards of Trustees Report. Medicare spending on Part A, Part B, and Part D benefits totaled $829 billion in 2021, up from $541 billion in 2013. The Congressional Budget Office (CBO) projects that net Medicare spending will grow from 3.1% of GDP in 2021 to 4.3% in 2032, and further increase to 5.9% of GDP by 2052.This means that Medicare is gradually becoming a larger component of the U.S. economy, with rising medical costs and benefit payments.Medicare’s primary source of funding comes from payroll taxes, income from the taxation of Social Security benefits, and income from a 3.8 percent surtax on investment income of high-income individuals. An increase among these would help mitigate any depletion of funds for the program. (Source: Centers for Medicare & Medicaid Services)

Drop in Commodity & Oil Prices Could Spur Lower Prices For U.S. Consumers

As market turmoil spread to all sectors of the economy, commodity prices including oil, have fallen as the fear of a global slowdown has escalated. Falling commodity and oil prices can be beneficial for U.S. consumers, whereas the costs of U.S. sourced materials for building homes could reduce the price of home construction, and the cost of domestically drilled and refined oil could reduce gasoline prices at the pump.Since tariffs affect imported goods and products, domestic goods and products won’t be imposed with such tariffs and will fare better than their imported counterparts. (Sources: Federal Reserve Bank of St. Louis, U.S. Commerce Dept.)

Market Update

Market Update (as of 03.31.2025)Stock Indices:

Dow Jones 42,001

S&P 500 5,611

Nasdaq 17,299Bond Sector Yields:

2 Yr Treasury 3.89%

10 Yr Treasury 4.23%

10 Yr Municipal 3.20%

High Yield 7.53%YTD Market Returns:

Dow Jones -1.28%

S&P 500 -4.59%

Nasdaq -10.42%

MSCI-EAFE 7.00%

MSCI-Europe 10.10%

MSCI-Pacific 0.90%

MSCI-Emg Mkt 4.40%US Agg Bond 2.78%

US Corp Bond 2.31%

US Gov’t Bond 2.70%US Agg Bond 0.53%

US Corp Bond 0.55%

US Gov’t Bond 0.53%Commodity Prices:

Gold 3,169

Silver 34.79

Oil (WTI) 71.64Currencies:

Dollar / Euro 1.08

Dollar / Pound 1.29

Yen / Dollar 149.77

Canadian /Dollar 0.69

Disclosure

Market Returns: All data is indicative of total return which includes capital gain/loss and reinvested dividends for noted period. Index data sources; MSCI, DJ-UBSCI, WTI, IDC, S&P.The information provided is believed to be reliable, but its accuracy or completeness is not warranted. This material is not intended as an offer or solicitation for the purchase or sale of any stock, bond, mutual fund, or any other financial instrument. The views and strategies discussed herein may not be appropriate and/or suitable for all investors. This material is meant solely for informational purposes, and is not intended to suffice as any type of accounting, legal, tax, or estate planning advice. Any and all forecasts mentioned are for illustrative purposes only and should not be interpreted as investment recommendations.